Suppliers

Suppliers Directory

Suppliers Directory Content Here

Blue Light Card

(Supplier)

Blue Light Card, Charnwood Edge Business Park, Syston Road, Cossington, LE7 4UP

Blue Light Card provides those in the NHS, Emergency Services, Social Care Sector and Armed Forces with discounts online and in-store.

Boots

(NCA Sponsor)

Boots Support Office, Customer Support Centre PO Box 5300, Nottingham, NG90 1AA

Boots Care Services

Boots Care Services has been helping care homes to manage their residents' health needs for over 30 years. During this time our service has continued to grow, and we are now the market leader in supporting care homes to deliver the best possible healthcare for their residents.

As one of the high street's most trusted brands, Boots Care Services supports residents and care teams with expert healthcare advice and regular visits from experienced pharmacists to help meet the highest of standards required by regulators.

We also provide an exclusive and valuable learning package for our carers and nurses with a suite of resources, including a wide range of topics and up-to-date patient-centred content, as well as a number of medication management modules.

We continue to strive to make the lives of patients better tomorrow than they are today

For more information on our service, please see below.

eMAR at Boots Care Services

Boots is uniquely placed to find the right eMAR (electronic medication administration record) solution for you and your organisation.

More and more care home organisations are reaping the rewards and benefits of eMAR with Boots. To further support care homes we are now offering remote implementations of eMAR .

- As the largest pharmacy provider to care homes Boots supports you on every step on your eMAR journey

- We know that different care homes have varying needs and preferences and we work to find the right solution for you

- Our training and implementation support is incredibly intuitive helping us lead the way in digital innovation and complete successful

Speak to our team:

If you are a care home and are interested in these services, speak to one of our team and we will work with you to identify the needs of your care home, and the most suitable options for you.

Call our Care Services team on 0115 949 4047 or email care@boots.co.uk. For eMAR enquiries please email emar@boots.co.uk

Caredemy

(Supplier)

Daniel Brown

Caredemy is delighted to announce that we are now a member of the National Care Association’s Supplier directory, delivering high quality health and social care training online to NCA members across the UK.

As a care skills academy, our partnership with the National Care Association (NCA) demonstrates our ongoing commitment to enhancing training standards for workers in the UK’s care sector.

How can working with Caredemy benefit NCA members?

Our association with the NCA underlines Caredemy’s core value of providing excellent training for the UK care sector. We believe it’s vital to build a strong relationship with our clients and pride ourselves on being adaptable to meet your needs.

We are delighted to offer NCA members access to our excellent range of care skills training courses which are specifically designed for the needs of UK care providers. The range includes care worker training courses and social care courses that are ideal for new entrants to the care sector as well as experienced care providers who need to carry out Continuous Professional Development (CPD).

Caredemy can also provide bespoke care staff training programmes for groups of staff from only £0.47p. This is ideal for when you have a large new intake who all need initial training, or if there is a particular course that you’d like to roll out throughout your staff. It can also help to standardise your employees’ CPD provision. A complimentary learner management system is included to track learn progress, reporting and access to certification.

Each Caredemy course is designed by expert professionals, accredited by the CPD Standards Office and meets the requirements of the relevant care frameworks. Every student receives extensive and clear course materials which contribute to the outstanding pass rates that our students achieve. Our courses are affordably priced, delivered online for maximum convenience and come with an Unlimited Resits guarantee.

So whether you are looking to induct a new recruit to the care sector, refresh current mandatory trainings or offer CPD options to your experienced, Caredemy can help. Get in touch today by emailing help@caredemy.co.uk or call us on 0203 488 7599 to discuss your requirements.

CareDocs

(Supplier)

Unit 6, Apex Court,, Almondsbury Business Park, Bristol, BS32 4JT

CareDocs is the UK’s leading person centred software provider for care and nursing homes. With over 15 years’ experience supporting healthcare professionals to manage their patient records with our point of care recording software, we are paving the way for digital transformation in the healthcare sector.

Striving to achieve the highest standards of compliance and care delivery for our clients, our software has unrivalled functionality in line with CQC standards. Working alongside industry bodies such as the National Care Association, our top priority is our clients and how we can help transform the care delivered to patients across the UK.

CareTutor

(Supplier)

The Lightbox, 111 Power Rd, London, W4 5PY

Luke Bond

CareTutor is an award winning social care eLearning platform launched in 2020 by BVS Training, which has over 25 years of experience in providing training for the care sector. We offer a go to destination for high-quality and engaging, video-based eLearning.

CareTutor was the 2024 winner of the Social Care Premier Supplier Award for Workforce Development. Our courses are rated at 9.2 out of 10 by learners from 1 Million+ course completions! Our partnership with the National Care Association (NCA) demonstrates our ongoing commitment to enhancing training standards for care workers in the UK’s care sector.

CareTutor courses provide huge savings on staff training costs compared to other training providers due to annual skills assessments which can negate the need for annual re-training if not required.

Our courses are peer reviewed by highly respected organisations such as the Alzheimer’s society and S.C.I.E.(Social Care Institute for Excellence).The courses can be used for induction and refresher training, covering the full Care Certificate (or equivalent), mandatory subjects such as Emergency First Aid, and Moving and Assisting, and a number of conditions courses. CareTutor is CPD accredited and endorsed by Skills for Care and is also a Skills for Care Centre of Excellence.

All our courses are produced using elements of either live-action videos filmed with professional actors in real care settings or animated scenarios, increasing engagement and retention from our learners. We also recently launched our new "Pathway" Enterprise level Learning Management System, which is packed with features and fully customisable to essentially deliver your organisation its own managed eLearning portal! CareTutor has Induction and Refresher/Skills Assessment versions of all courses.

Refresher training can be avoided if annual skills assessments are passed creating huge time and cost savings on paying staff to complete refresher training courses if the knowledge has been retained and is not required.

CareTutor courses are highly visual and engaging ensuring retention rates are high and therefore retraining is required less frequently saving £££ on staff costs.

Call us or email for your free demo and trial account!

Circadacare

(Supplier)

Circadian Lighting LTD, Newcastle, NE4 5TG

Joe

Circadacare is a science-led health tech company, our mission is to improve the wellbeing of residents in care by combining the benefits of advanced AI -powered monitoring and Circadian Lighting. Our latest offering, Heleos, is an all -in - one, plug and play device that provides both Circadian Lighting and AI - powered monitoring, 24/7. Heleos , is transferable into most care environments and eco-systems, notably Care Homes, Home Care and Independent living.

Citation

(NCA Sponsor)

Whether you're starting a care business or growing one, at Citation you’ll find everything you need to help you get HR & Employment Law, Health & Safety and CQC compliance right.

How?

- 24/7 expert advice – Round-the-clock phone access to expert HR and Health & Safety professionals

- Atlas, their smart compliance technology – Manage essential HR and Health & Safety tasks, training and documentation in one place with the Atlas online hub

- Specialist on-site support – Annual HR check-ins and site visits delivered by their lovely local consultants

- Advice so good, it’s guaranteed – As long as you follow their advice, they’ll defend you against tribunal claims up to £1.5million a year

- Documentation, sorted – Policies, risk assessments, contracts – their experts have them covered for you, so you can focus on what you do best

- CQC Pro – Ace your inspections and tick off your regulatory obligations with this handy online tool

- Care mock inspections – Avoid any surprises when the regulator comes to call with mock inspections by Citation’s professional team

- Care policies and procedures – Researched and written by care sector professionals

- Cyber security – From system audits to threat detection and response planning

Kick things off with Citation today

Get in touch with Citation to organise a free audit of your business and start saving time, stress and money. Simply call 0345 844 1111 or click here for more information. Remember to quote ‘National Care Association’ when enquiring to access preferential rates.

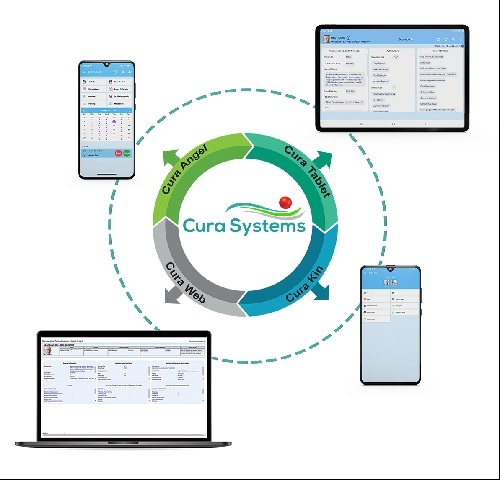

Cura Systems

(Supplier)

33 Lodge Close, Canons Drive, Edgware , HA8 7RL

John Rowley Senior Sales Manager

Cura is a specialised digital system designed for complex care settings. It has been approved by the NHS England Transformation Directorate to be on the assured supplier list for digital social care records.

Cura makes a significant difference, for example, monitoring service users’ conditions accurately and in real-time by using highly configurable assessments, person-centred care plans, reminders, activities and timelines specifically designed for settings that deal with severe dementia, challenging behaviour, mental health, physical and sensory disabilities, palliative care, long-term chronic illnesses, autism and profound learning difficulties.

Cura also provides a sophisticated, in-depth incident reporting tool designed to facilitate accurate and timely records of even the most severe incidents in a simple guided way. Tools are available to highlight events, persons, times of day and locations that increase the risk of incident occurrence.

“Cura incident reporting really is a great tool and will make a huge difference to the people we support. The ease we have of reviewing the incidents as they are logged and the central monitoring will only enhance our ability to analyse and resolve the issues we see.

I look forward to seeing how we can develop even more with Cura by our side. - Anthony Birmingham, Service Manager, Positive Individual Proactive Support

DDC Dolphin Ltd

(Supplier)

Zoe Allen

DDC Dolphin are specialists in sluice room solutions, with over 30 years of experience we are the only UK manufacturer able to offer the full range of sluice room products.

We understand that a reliable and well planned sluice room is key to ensuring excellent hygiene and infection control standards are met. Our extensive range of washer disinfectors, macerators and sluice room furniture encompass a wide range of individual features to help reduce the risk of cross contamination and include as standard hands free technology and anti-microbial coatings which inhibit the growth of bacterial spores, helping to ensure that your sluice room's surfaces remain safe preventing the spread of infection. Many years of experience allows us to give comprehensive and meaningful advice and support for new or existing facilities, tailoring solutions to your requirements and enabling you to meet modern infection control standards as efficiently as possible.

Fire Door Controls

(Supplier)

Arena Business Centre, 9 Nimrod Way, Ferndown, BH21 7SH

Ian Rowe

Fire Door Controls is a specialist supplier of alarm activated fire door closers and holders with particular expertise in free-swing solutions for bedroom doors in residential care settings.

Independent of any manufacturer, we provide unbiased advice on the respective pros and cons of the full range of available options including hard-wired, acoustic and radio activated systems.

Primarily serving the Care Sector, we also offer full installation and maintenance services nationwide and have extensive experience working within operational care homes.